Crypto Tax Reports,

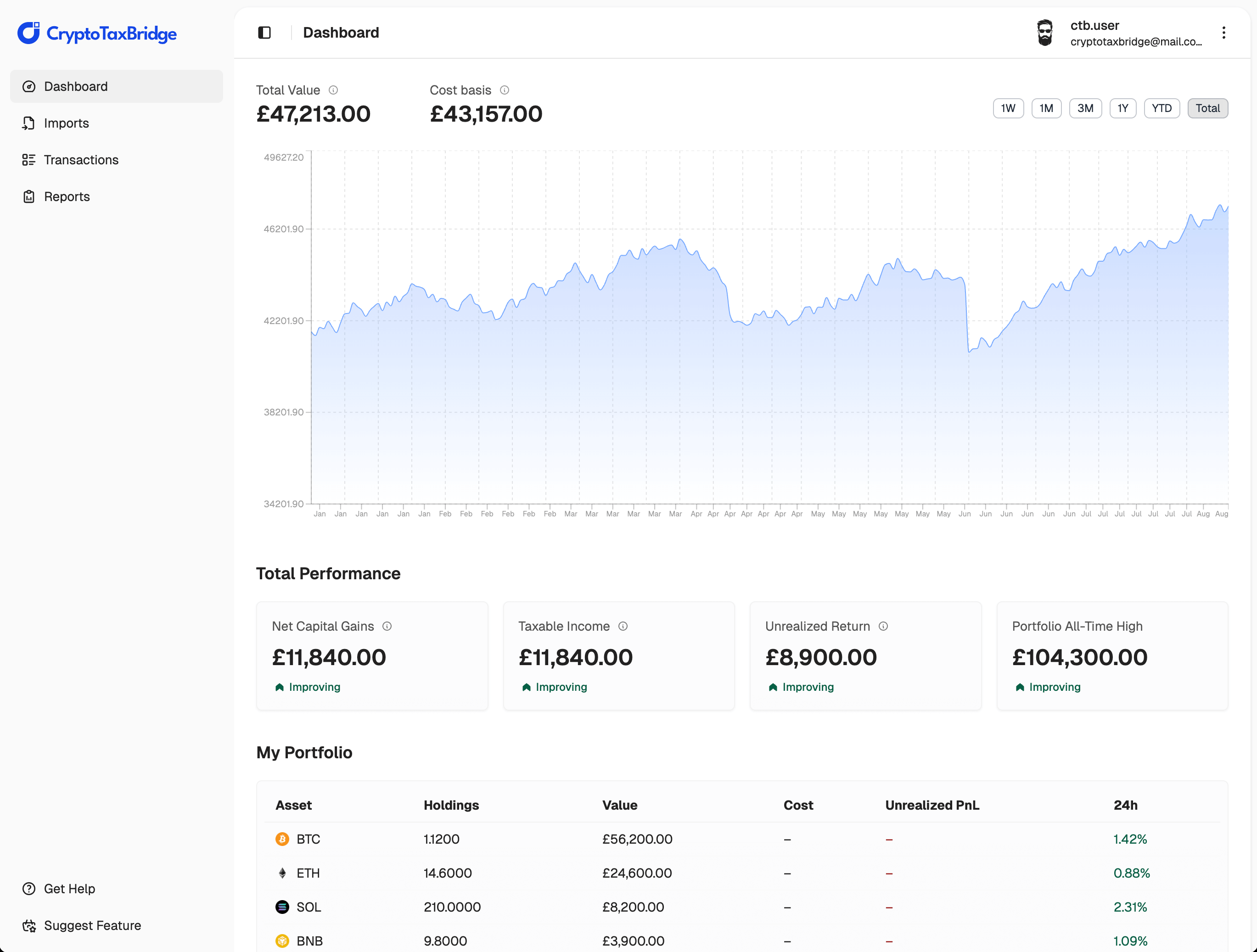

Done Properly

Import your exchange data, calculate capital gains using HMRC-compliant rules, and generate a ready-to-file UK crypto tax report in minutes.

How CryptoTaxBridge Works

CryptoTaxBridge turns raw exchange data into compliant crypto tax reports using country-specific tax rules and transparent calculations.

Import your transaction data

Import transactions from supported exchanges via API or upload CSV files for historical data.

Apply tax rules and calculate gains

Transactions are processed using country-specific tax rules to calculate capital gains, disposals, and taxable events.

Download your tax report

Generate structured, ready-to-file tax reports suitable for accountants and local tax authorities.

Pay Once. Generate Your Tax Report.

Pricing is based on your transaction volume for a single tax year. No subscriptions.

Starter

For simple portfolios and light trading activity.

one-time per tax year

Generate ReportPay once · No subscription

- Up to 100 transactions

- Unlimited regenerations per tax year

- Complete crypto tax calculations for the selected tax year

- CSV & PDF export

- Email support

Investor

For active investors with regular trading.

one-time per tax year

Generate ReportPay once · No subscription

- Up to 1,000 transactions

- Unlimited regenerations per tax year

- Complete crypto tax calculations for the selected tax year

- CSV & PDF export

- Priority processing

Trader

For frequent and high-volume trading.

one-time per tax year

Generate ReportPay once · No subscription

- Up to 3,000 transactions

- Unlimited regenerations per tax year

- Complete crypto tax calculations for the selected tax year

- CSV & PDF export

- Priority support

Pro

For very large portfolios and power users.

one-time per tax year

Generate ReportPay once · No subscription

- Up to 10,000 transactions

- Unlimited regenerations per tax year

- Complete crypto tax calculations for the selected tax year

- CSV & PDF export

- Dedicated support

All plans include GDPR-compliant data handling and AES-256 encryption at rest.

Trusted by crypto traders and professionals

Feedback from early users who generated clear, compliant crypto tax reports with CryptoTaxBridge.

“I used to spend days cleaning and merging CSVs from different exchanges. CryptoTaxBridge generated a clean tax report in minutes that matched exactly what my accountant needed.”

“The calculations closely matched my own spreadsheet, which gave me confidence in the results. I just uploaded my data and generated the report.”

“A crypto tax tool that stays focused on reporting. Clear interface, sensible tax logic, and no unnecessary complexity.”

“Having reports in a consistent, standardised format makes reviewing data much easier. CryptoTaxBridge produces outputs that are clear and predictable.”

Got questions?

We’ve got answers.

Everything you need to know about using CryptoTaxBridge — from integrations and reports to data security and pricing.